### Overview of Bonds

Bonds are debt securities issued by entities such as governments, municipalities, corporations, or other organizations to raise capital. When you purchase a bond, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value (principal) at maturity. Bonds are considered fixed-income investments because they provide regular interest income.

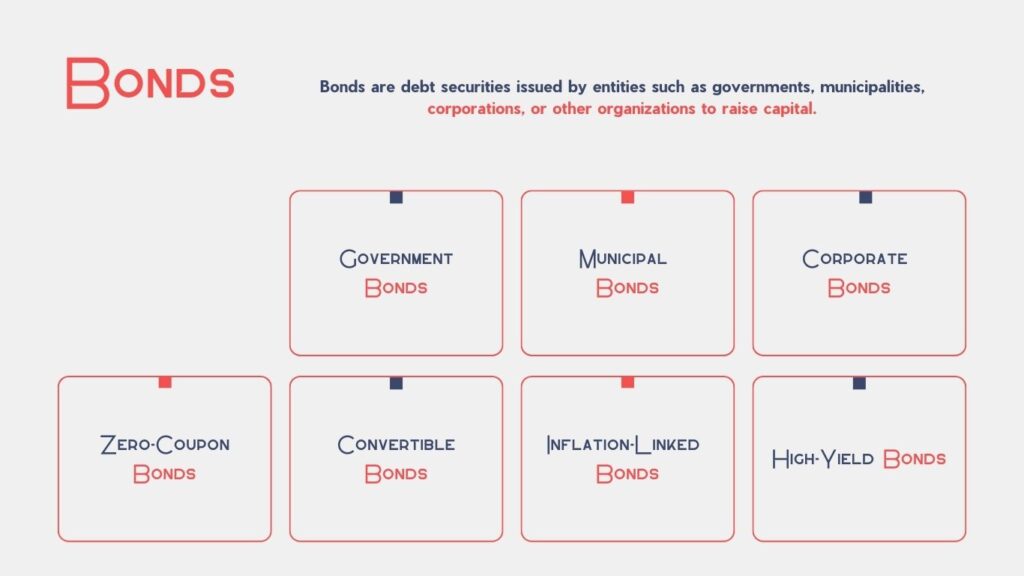

### Types of Bonds

#### 1. **Government Bonds**

– **Description:** Issued by national governments. In the U.S., these are known as Treasury bonds, notes, and bills.

– **Benefits:** Generally considered low-risk due to government backing.

– **Risks:** Interest rate risk, inflation risk.

#### 2. **Municipal Bonds**

– **Description:** Issued by state, municipal, or local governments to fund public projects.

– **Benefits:** Often tax-exempt, providing tax-free interest income.

– **Risks:** Credit risk, interest rate risk.

#### 3. **Corporate Bonds**

– **Description:** Issued by corporations to raise capital for business activities.

– **Benefits:** Higher interest rates compared to government bonds.

– **Risks:** Credit risk, interest rate risk, company performance risk.

#### 4. **Zero-Coupon Bonds**

– **Description:** Sold at a discount and pay no periodic interest. The investor receives the face value at maturity.

– **Benefits:** No reinvestment risk, beneficial for long-term goals.

– **Risks:** Interest rate risk, price volatility.

#### 5. **Convertible Bonds**

– **Description:** Corporate bonds that can be converted into a specified number of the issuing company’s shares.

– **Benefits:** Potential for capital appreciation if the company’s stock price increases.

– **Risks:** Lower interest rates compared to non-convertible bonds, equity risk.

#### 6. **Inflation-Linked Bonds**

– **Description:** Provide returns tied to inflation rates. In the U.S., these are known as Treasury Inflation-Protected Securities (TIPS).

– **Benefits:** Protect against inflation.

– **Risks:** Lower initial interest rates, inflation risk if inflation expectations are not met.

#### 7. **High-Yield Bonds (Junk Bonds)**

– **Description:** Issued by companies with lower credit ratings. Offer higher interest rates to compensate for higher risk.

– **Benefits:** Higher potential returns.

– **Risks:** Higher credit risk, market risk.

### Benefits of Bonds

1. **Stable Income**

– Provide regular interest payments, creating a steady income stream.

2. **Capital Preservation**

– Principal is returned at maturity, preserving the initial investment.

3. **Diversification**

– Adding bonds to a portfolio can reduce overall risk and volatility.

4. **Lower Risk Compared to Stocks**

– Generally, bonds are less volatile than stocks, making them suitable for conservative investors.

5. **Tax Advantages**

– Some bonds, like municipal bonds, offer tax-free interest income.

### Risks of Bonds

1. **Interest Rate Risk**

– Bond prices move inversely to interest rates. When rates rise, bond prices fall, and vice versa.

2. **Credit Risk**

– The risk that the issuer may default on interest payments or fail to return the principal.

3. **Inflation Risk**

– Inflation can erode the purchasing power of future interest payments and principal.

4. **Reinvestment Risk**

– The risk that interest or principal payments will be reinvested at lower interest rates.

5. **Liquidity Risk**

– Some bonds may be difficult to sell quickly without affecting the price.

### How to Invest in Bonds

1. **Determine Investment Goals**

– Assess your financial objectives, risk tolerance, and time horizon.

2. **Choose Bond Type**

– Select bonds that align with your goals, such as government bonds for safety, corporate bonds for higher yields, or municipal bonds for tax advantages.

3. **Research Issuers**

– Evaluate the creditworthiness of the issuer by checking credit ratings from agencies like Moody’s, S&P, and Fitch.

4. **Decide on Direct or Indirect Investment**

– Invest directly in individual bonds or indirectly through bond mutual funds or ETFs.

5. **Understand the Terms**

– Review the bond’s interest rate, maturity date, and any special features like convertibility or callability.

6. **Diversify**

– Spread investments across different types of bonds and issuers to reduce risk.

7. **Monitor and Rebalance**

– Regularly review your bond investments and adjust your portfolio as needed to stay aligned with your financial goals.

### Conclusion

Bonds are an essential component of a diversified investment portfolio, offering stability, income, and lower risk compared to equities. By understanding the different types of bonds, their benefits, and associated risks, investors can make informed decisions that align with their financial objectives. Regular monitoring and strategic adjustments ensure that bond investments contribute effectively to achieving long-term financial goals.