### Topics for Stock Market Training in India

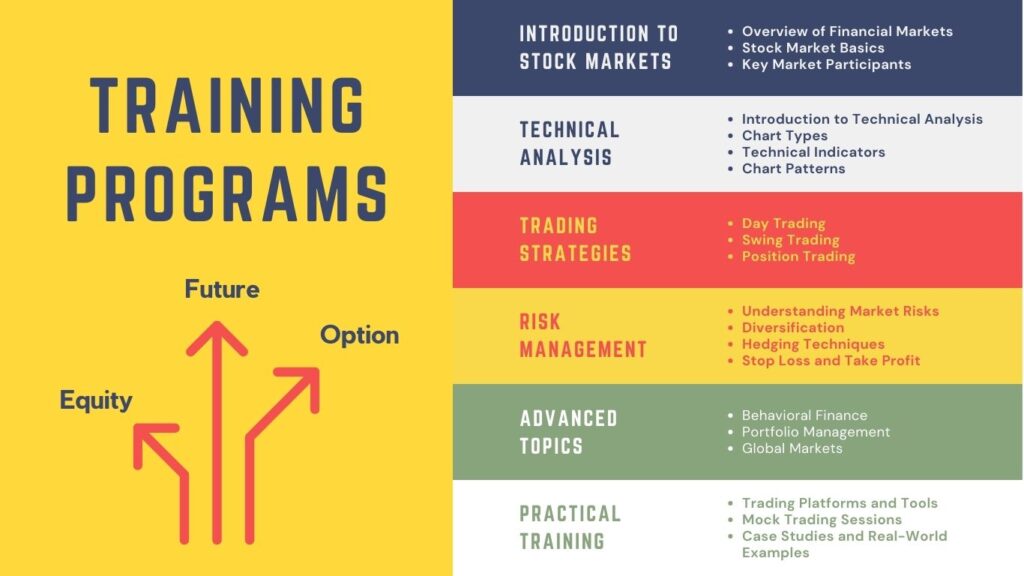

Stock market training is essential for investors who wish to navigate the complexities of the market effectively. Below are some comprehensive topics that can be included in stock market training programs in India:

### Introduction to Stock Markets

1. **Overview of Financial Markets**

– Understanding different types of financial markets (equity, debt, forex, commodities).

– Role and importance of stock markets in the economy.

2. **Stock Market Basics**

– What is a stock?

– Types of stocks: Common vs. Preferred stocks.

– Stock exchanges in India: NSE, BSE.

3. **Key Market Participants**

– Retail investors, institutional investors, brokers, regulators (SEBI).

### Market Instruments

4. **Types of Financial Instruments**

– Equity shares, bonds, mutual funds, ETFs, derivatives (futures and options).

5. **Initial Public Offerings (IPOs)**

– Process of IPOs.

– How to apply for IPOs.

– Evaluating IPOs.

### Fundamental Analysis

6. **Financial Statements Analysis**

– Reading balance sheets, income statements, and cash flow statements.

7. **Ratio Analysis**

– Key financial ratios (P/E ratio, PEG ratio, ROE, ROA).

8. **Valuation Techniques**

– Discounted Cash Flow (DCF), Price/Earnings to Growth (PEG) ratio, etc.

### Technical Analysis

9. **Introduction to Technical Analysis**

– Difference between technical and fundamental analysis.

10. **Chart Types**

– Line charts, bar charts, candlestick charts.

11. **Technical Indicators**

– Moving Averages, Relative Strength Index (RSI), MACD, Bollinger Bands.

12. **Chart Patterns**

– Head and Shoulders, Double Top/Bottom, Cup and Handle.

### Trading Strategies

13. **Day Trading**

– Strategies and risk management for intraday trading.

14. **Swing Trading**

– Medium-term trading strategies.

15. **Position Trading**

– Long-term trading and investment strategies.

16. **Algorithmic Trading**

– Basics of algo trading and automated trading systems.

### Risk Management

17. **Understanding Market Risks**

– Systematic vs. unsystematic risk.

18. **Diversification**

– Importance and techniques of diversifying a portfolio.

19. **Hedging Techniques**

– Using derivatives for hedging risks.

20. **Stop Loss and Take Profit**

– Setting stop-loss orders to manage risk.

### Regulatory Framework

21. **SEBI Regulations**

– Understanding the role of SEBI.

– Key regulations and compliance requirements.

22. **Taxation in Stock Markets**

– Tax implications on stock trading and investments.

– Short-term and long-term capital gains tax.

### Advanced Topics

23. **Behavioral Finance**

– Understanding investor psychology and market sentiment.

24. **Portfolio Management**

– Basics of creating and managing a portfolio.

– Asset allocation and rebalancing.

25. **Global Markets**

– Introduction to international stock markets.

– Impact of global events on Indian markets.

### Practical Training

26. **Trading Platforms and Tools**

– Introduction to trading platforms (e.g., Zerodha, Upstox).

– Using analytical tools and software.

27. **Mock Trading Sessions**

– Simulated trading sessions to practice strategies.

28. **Case Studies and Real-World Examples**

– Analyzing historical market events.

– Learning from successful investors and traders.

### Conclusion

29. **Building a Trading Plan**

– Creating a personalized trading or investment plan.

– Setting realistic goals and timelines.

30. **Continuous Learning and Development**

– Importance of staying updated with market news and trends.

– Resources for continuous learning (books, online courses, seminars).

### Conclusion

These topics cover the essentials and advanced aspects of stock market trading and investing, providing a comprehensive training program for individuals looking to enhance their knowledge and skills in the Indian stock market.